Weak Jobs Numbers Lead To Lower Mortgage Rates

Employment data was released this week in the form of the monthly ADP payroll report and the all-important BLS jobs report. For the first time in recent memory, both reports were duds.

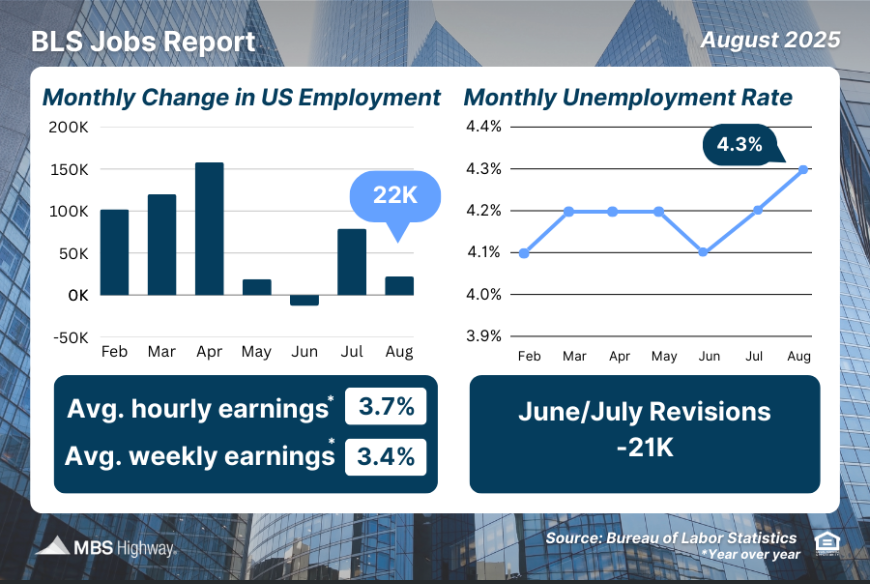

Unemployment ticked up to 4.3%, revisions to June & July reports were negative (-21,000 jobs), and a jobs market that to this point has been so strong it’s kept the Fed from reducing rates seems to be teetering toward sustained weakness. When jobs numbers falter, the Fed seems to have one tool at their disposal to help boost the economy – reduced rates.

That explains why mortgage loans have seen consistently improving pricing in recent weeks, and on the heels of today’s jobs reports, mortgage rates fell to their best levels since September of 2024.

What Does The Crystal Ball Show?

Jobs data has been consistently difficult to predict, with the monthly BLS report blocking Fed rate cuts and mortgage rates improvements over the past year with extremely volatile data, which ultimately led to the firing of the BLS head last month. While the firing was politicized, it came after months of headline data showing huge discrepancies from later revisions (aka…the data, when released, was very inaccurate). Now that we’re seeing continued weakness in the jobs market, it’s almost a certainty that the Fed will be cutting the Fed funds rate (important to remember: the Fed funds rate is NOT the rate home buyers or home owners get, it’s the rate at which banks borrow from the Fed and from each other) later this month after their September meeting (that meeting is scheduled 9/16-9/17).

The one area of uncertainty still in the air is inflation – with tariff impacts still not fully understood, if inflation rises or shows sustained levels above the Fed’s target levels, rate hikes could still come very slowly, but if the jobs market continues to show signs of weakness and inflation remains in check, rates should begin a sustained drop as the Fed works to avoid recession. This is the most likely scenario, with markets currently betting on at least a couple of Fed rate reductions before the end of 2025, and while the Fed rate move doesn’t directly impact mortgage rates, the Fed moves are driven by the same economic factors that influence mortgage rates, so we expect to see mortgage rates continue to slowly decrease as well.

Should I Refinance, Or Wait Until Rates Drop Further?

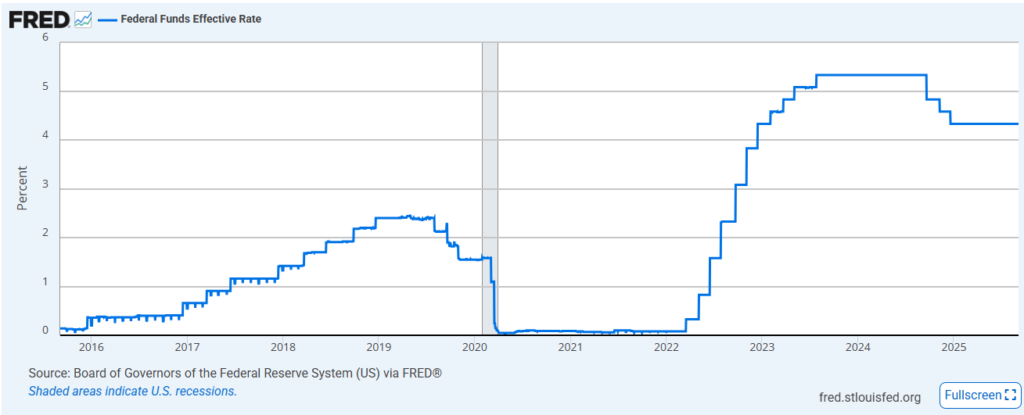

This is a question people often ask during times when rates begin to fall – should you pull the trigger today, or wait? To make the right decision, several things need to be accounted for – the biggest being how long you plan to own your home that the mortgage is attached to. Fed rate hikes and cuts tend to come in cycles of ~2-3 years. You can see in the chart below how the Fed funds rate has ebbed and flowed over the past decade. The Fed hiked rates from 2016 until late 2019, then cut rates and held them low from 2020 until 2022 (during the pandemic and resulting inflation). Rates then rose and remained elevated until late 2024 when the Fed began cutting again – if the trend continues, we should see a stable or declining rate environment for the foreseeable future.

For that reason, anyone that refinances today to take advantage of some savings from recent rate drops could very well have an additional refinance opportunity in the later stages of the next economic cycle. So while a lower rate may be available down the line, that doesn’t mean you shouldn’t take advantage of savings that are available today! There’s very little downside to refinancing multiple times, especially when you get loans with low (or no!) closing costs.

If you’d like to see if refinancing makes sense today, we’d be happy to help – we offer FREE, absolutely-no-obligation consultations to help you make the right decision and help ensure you have the right loan for your unique situation. You can get in touch by clicking here.