How The Government Shutdown Impacts Real Estate

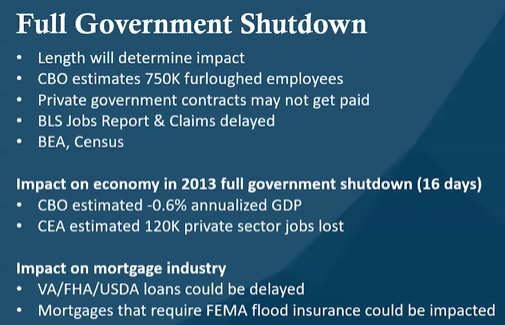

As of midnight today, Wednesday 10/1/2025, the government has shut down. With an impasse in funding, the federal government has closed it’s doors on operations as congress works to reconcile monetary disagreements. This shutdown is the first since 2018. That shutdown was the longest in history, lasting over a month from December into January 2019. While short shutdowns have occurred previously with minimal impact on most people’s day to day life, longer shutdowns can have some real impact.

In real estate, government shutdowns provide insight into just how involved the federal government is in just about every aspect of day to day life, with longer periods of shut down having very real ramifications for home owners and those buying and selling real estate.

Loan Programs Impacted

While most of the loans in the US (conventional loans) aren’t impacted directly by a government shutdown, certain aspects of these transactions can be. For one, federal workers can have their income delayed, which can cause issues when they have a mortgage application in process. While more rare, there can also be delays in verifications needed from federal entities (for customers needing things from the IRS, for example). For the most part, though, a government shutdown – especially a short one – has little to no impact on conventional loans.

Which loans see a bigger and more immediate impact? Government loans. These loans include FHA loans, VA loans, and USDA loans. While FHA & VA loans won’t see too much disruption in a short shutdown, they could run into issues should the shutdown drag out for weeks or more.

For FHA/HUD loans, impact should be minimal – exceptions include the HECM reverse mortgage product, and loans needing FHA underwriter review.

VA loans are covered short term by carry over funds, so if the shut down is short, there should be minimal impact. If the existing funds dry up in a prolonged government shutdown, the VA program would be expected to start seeing delays.

USDA is typically the program most immediately impacted by a government shutdown – most operations within USDA stop, and since the department is so involved in the loan process, the loan process can stop with it. This unfortunately includes the most popular USDA home buying program – the single-family guaranteed loan. While it’s a big deal for USDA buyers, this is a very small market segment, so big picture nationally, this impact should be minimal.

Government Services

There are several government services used in the processing of most mortgage loans, and disruptions will vary based on status and the duration of the shutdown.

Flood insurance is managed by FEMA, and while existing flood insurance policies remain in place, there can be delays or freezes to renewal policies.

IRS verification services should mostly remain up and running as many of these are automated, however those needing manual assistance could run into issues if the shutdown is prolonged as IRS services may be limited.

Social security verification services are also likely to be paused, which could cause delays in processing and the implementation of work arounds.

The People Relying On The Government

The biggest impact from a shutdown that can be immediately felt is for those government workers that are furloughed and see a disruption to their income and livelihood. There’s an estimated 750,000 government employees that would be expected to be furloughed, and if they are in the process of buying a home or refinancing, they could see significant delays as their income is disrupted. Typically, lenders can proceed with an application and keep a loan moving, but closing may be delayed until income is restored and an employee returns from furlough.

While a short government shutdown will likely have some negative impacts around the country, those impacts will be limited and should be easily rectified upon reopening. The longer the shutdown lasts and the more programs that see funding dry up, the greater the impact will be. At Catalyst, we’re working to keep loans moving seamlessly and will continue to do so regardless of the time period the government remains closed.