“No Closing Costs” vs Mortgages with Closing Costs

Before diving too far into a conversation about the comparison of a “no closing cost” mortgage to a more traditional cost structure, it’s important to start with a disclaimer: There is no true “no closing cost” loan. When “no closing costs” is advertised in the mortgage industry, it’s referring to “who” or “how” closing costs are paid. On every mortgage, certain things need to happen, and those things are done by professionals who charge for their services. For example, a title company has to record a new mortgage deed when a new mortgage is completed – the county where it’s recorded will charge a recording fee, and the title company has charges for those services – so there are always going to be costs – but consumers/customers don’t always have to pay for those costs. This is important to understand, because it’s often misleading and confusing – there is no true “Free” mortgage, there are always costs, and always someone paying them.

Why a “No closing cost” loan?

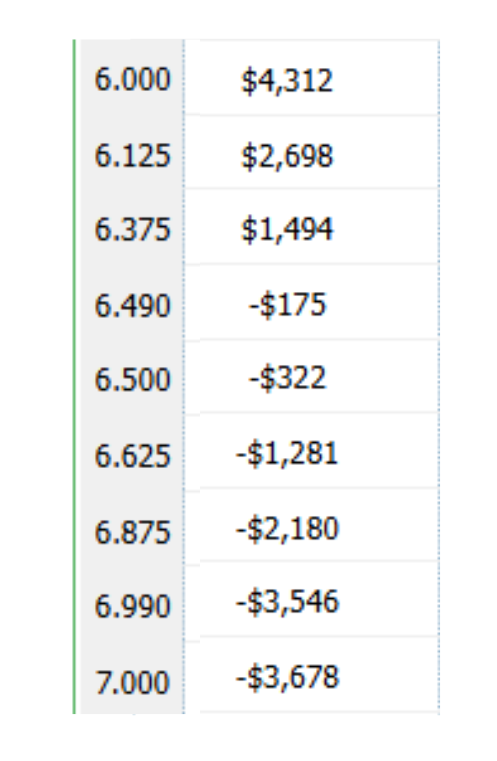

No closing cost mortgage loans make sense for several reasons and scenarios, but they aren’t for everyone. When a mortgage is done as a “no cost” loan, it means the costs are paid by someone else – most often the lender. To ensure loan profits, lenders often offer higher interest rates that come with rebates (the higher the rate, usually the larger the rebate), and those rebates are used to pay the closing costs. See the graphic here – it illustrates the cost (or credit/rebate) for a loan – in this example, a $350,000 loan amount (keep in mind, this is not a “real rate sheet” for today, so it’s not to be misconstrued as a rate quote, but is showing how pricing works on lender rate sheets. You can see the lower rate comes with a credit/rebate (indicated by the negative (-) symbol next to the dollar amount. In this example of a $350,000 loan amount, the payment difference between a 6% and 7% is about $230/month. And since 6% costs $4312 and 7% has a rebate of $3678, it means the difference in “price” for those rates is nearly $8,000.

So in the example above, which loan makes the most sense? Well, if you believe rates will continue to decline and that you’ll see savings opportunities in the near future as a result, it may be worth choosing a higher rate to limit closing costs. After all, the $230 monthly cost difference between a 6% & 7% in this example would reach the $8000 cost difference between the two options in just under 3 years. And in some cases a $3678 rebate would offset a large chunk of closing costs. So generally speaking, in the short term, a higher rate and big lender credit could be the right move. Over time, though, the lower rate will start to make more sense.

What’s right for you?

The right move for your mortgage ultimately depends on your unique scenario, belief in what the markets will do, and whether or not monthly budget or overall cost is a bigger priority. It’s important to work with a knowledgeable loan officer that can explain and walk you through various options, but ultimately, the decision is yours – but it’s important to realize that “no cost” isn’t always a good thing (and in reality, it’s a misleading phrase, because consumers do pay the costs – just through a higher rate!), and higher costs aren’t always a bad thing if they come with lower rates.

Our loan officer team is trained to help walk you through all of your loan options and help you determine what loan product (and cost structure!) is best for you. If you have any questions we’re here and happy to help – you can have all your questions answered here.